New Federal Tax Relief related to COVID

The latest information related to COVID relief is in the form of two new Federal bills that provide extended financial relief.

The Bipartisan COVID-19 Emergency Relief Act of 2020:

This bill has several payroll provisions that include a second PPP loan through the SBA (Small Business Administration) based on limited eligibility. The qualifications of this loan are small businesses with less than 301 employees and with lost revenue of 30% or more during any 3-month period of 2020. The expenses covered in this bill extend safety operations and cover supplier costs, facility “modifications.” PPP loans of $150,000 or less are eligible for a much more streamlined forgiveness process.

Unemployment is included in this Act as well. It extends all unemployment insurance programs by 16 weeks, beginning January 1, 2021. Any Federal supplement to unemployment received is also extended expanded for the same period, by $300 per week.

The Bipartisan State and Local Support and Small Business Protection Act of 2020:

This bill provides $160 billion in governmental relief designated for State, municipal and tribes. Additionally, it pushes back the deadline to spend the CARES Act Coronavirus Relief Funding to December 31, 2021.

There is guidance included in this bill to provide “liability protection” for businesses. Those businesses trying to follow current health standards, would not be responsible under federal unemployment law due to COVID-19 exposure and working environment changes.

We have compiled the following useful and concise information for your reference as you consider the various planning opportunities available to address the impact of the COVID-19 situation on nonprofit organizations. After studying the recently enacted law and interacting with other professionals, by parsing through the voluminous CARES Act, Families First Coronavirus Response Act (“FFCRA”) and relevant peripheral materials, the following includes the highlights of the relevant relief available to you via the government stimulus packages:

We have compiled the following useful and concise information for your reference as you consider the various planning opportunities available to address the impact of the COVID-19 situation on nonprofit organizations. After studying the recently enacted law and interacting with other professionals, by parsing through the voluminous CARES Act, Families First Coronavirus Response Act (“FFCRA”) and relevant peripheral materials, the following includes the highlights of the relevant relief available to you via the government stimulus packages:

Small businesses looking to get some relief from the Payroll Protection Program may run into a snag or two. Because this stimulus package was passed so quickly, the banks are not necessarily prepared to handle the loans like the media initially described. This

Small businesses looking to get some relief from the Payroll Protection Program may run into a snag or two. Because this stimulus package was passed so quickly, the banks are not necessarily prepared to handle the loans like the media initially described. This

Langdon & Company LLP is pleased to announce that Meagan L. Bulloch, CPA has been admitted as partner in our audit practice. Meagan joined Langdon & Company LLP in 2008 and has over ten years of public accounting experience including work for Ernst and Young LLP in their Raleigh, NC office. She is a graduate of North Carolina State University with a Bachelor of Science and Masters of Science in Accounting.

Langdon & Company LLP is pleased to announce that Meagan L. Bulloch, CPA has been admitted as partner in our audit practice. Meagan joined Langdon & Company LLP in 2008 and has over ten years of public accounting experience including work for Ernst and Young LLP in their Raleigh, NC office. She is a graduate of North Carolina State University with a Bachelor of Science and Masters of Science in Accounting.

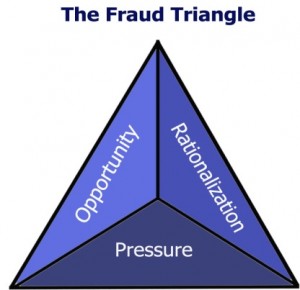

The line between liabilities and equity is also critical in measuring income. So companies began to take advantage of manipulating their debt and equity and therefore manipulating their net income. Neither changes in the values of a company’s outstanding equity instruments or transactions between a company and its owners, affect reported income. Whereas, interest payments and at least some changes in the values of liabilities actually do affect reported income.

The line between liabilities and equity is also critical in measuring income. So companies began to take advantage of manipulating their debt and equity and therefore manipulating their net income. Neither changes in the values of a company’s outstanding equity instruments or transactions between a company and its owners, affect reported income. Whereas, interest payments and at least some changes in the values of liabilities actually do affect reported income.