Your not-for-profit is likely governed by a core group of board members. But the addition of an informal advisory board

If your organization offers a 401(k) plan, you’re probably aware that you can lay down some rules regarding when participants

Contact Langdon & Company LLP today for help in valuing your business!

For some business owners, succession planning is a complex and delicate matter involving family members and a long, gradual transition

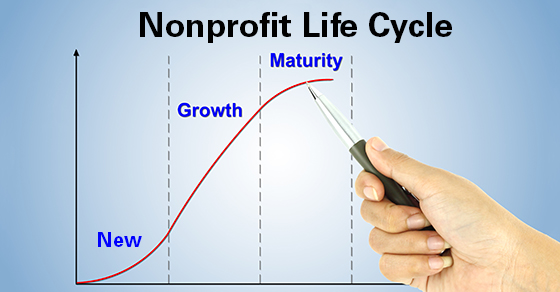

Successful not-for-profits typically proceed along a standard life cycle. Their early stage precedes a growth period that runs several years,

When your not-for-profit desperately needs a new facility, costly equipment or an endowment, a capital campaign can be the best