COVID-19 Links

In an effort to streamline the ever-changing world we live in with the COVID-19 virus, here are some links that are all related to updated tax changes, small businesses, individual sick leave, and other filing requirements. As more information is released, it will be added at the top of this list.

In an effort to streamline the ever-changing world we live in with the COVID-19 virus, here are some links that are all related to updated tax changes, small businesses, individual sick leave, and other filing requirements. As more information is released, it will be added at the top of this list.

Have you been using zoom? https://www.forbes.com/sites/leemathews/2020/04/13/500000-hacked-zoom-accounts-given-away-for-free-on-the-dark-web/#58a7fbc858c5

US Dept of Treasury Grants Additional Income Tax Filing and Payment Relief https://www.irs.gov/pub/irs-drop/n-20-23.pdf

New NonProfit Extensions https://home.treasury.gov/news/press-releases/sm970

CDC Recommendations https://www.cdc.gov/coronavirus/2019-ncov/index.html

COVID-19 Relief Tracker https://www.forbes.com/sites/briannegarrett/2020/03/20/small-business-relief-tracker-funding-grants-and-resources-for-business-owners-grappling-with-coronavirus/#1e1e001bdd4c

There’s hope for Small Businesses! https://www.wraltechwire.com/2020/04/03/bank-of-america-accepting-virus-crisis-loan-applications-receives-10000-in-first-hour/

Key Highlights of the CARES Act and the FFCRA Relief Provisions https://www.langdoncpa.com/?p=4717&preview=true

SBA loans more difficult than we thought https://www.langdoncpa.com/2020/04/03/sba-loans-may-be-more-difficult-than-we-thought/

Employer tax credits, and more https://www.journalofaccountancy.com/news/2020/apr/irs-new-employer-tax-credits-form-employee-retention-credit-guidance-coronavirus.html

More Assistance for Nonprofits https://www.councilofnonprofits.org/trends-policy-issues/loans-available-nonprofits-the-cares-act-public-law-116-132

NC Press Release: Deferred Interest https://www.langdoncpa.com/2020/04/01/press-release-nc-deferring-interest/

Applications for Small Business Paycheck Protection Program https://www.journalofaccountancy.com/news/2020/mar/paycheck-protection-loan-for-small-businesses-coronavirus-pandemic.html

Employer questions answered! https://www.dol.gov/agencies/whd/employers

SBA debt relief related to COVID-19 https://www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources#section-header-4

Gift tax returns extended too! https://www.journalofaccountancy.com/news/2020/mar/gift-gst-tax-returns-postponed-filing-deadlines-coronavirus-pandemic.html

Assisted Living Resources for COVID-19 https://www.ncala.org/covid-19.html

How much COVID-19 stimulus will I receive? https://www.cnbc.com/2020/03/27/the-stimulus-payment-calculator-tells-you-how-much-money-you-could-get.html

Possible Increase for VA Nursing Facilities https://www.vhca.org/publications/careconnection/march-26-2020/vhca-vcal-seeking-additional-funding-for-nf-care-under-covid-19-emergency/

COVID-19 Resources for Non-Profits https://www.ncnonprofits.org/resources/pandemicresources

The CARES Act questions answered https://www.journalofaccountancy.com/news/2020/mar/cares-act-economic-relief-coronavirus-tax-provisions.html?utm_source=mnl:alerts&utm_medium=email&utm_campaign=25Mar2020&utm_content=headline

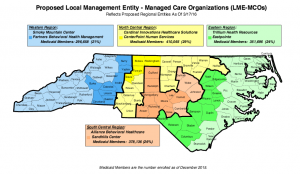

NC DHHS provides additional COVID-19 support https://www.ncdhhs.gov/news/press-releases/nc-medicaid-increases-support-protect-those-most-risk-serious-illness-covid-19

Clarification on NC Tax Deadlines https://www.ncacpa.org/wp-content/uploads/2020/03/Frequently-Asked-Questions-COVID-final.pdf?utm_source=Google&utm_medium=Referral&utm_campaign=NCACPA&_zs=fG9HX&_zl=MMK22

Employers using Payroll Tax Credits for Paid Leave due to Coronavirus https://www.accountingtoday.com/news/employers-can-begin-using-payroll-tax-credits-for-paid-leave-for-coronavirus

CMS extends Cost Report Deadlines https://www.palmettogba.com/palmetto/providers.nsf/ls/JM%20Part%20A~BMYLSN5443?opendocument&utm_source=J11AL&utm_campaign=JMALs&utm_medium=email

Small Business Q&A https://sbshrs.adpinfo.com/covid19-faqs

IRS push back tax FILING deadline https://abc11.com/business/tax-day-pushed-back-amid-viral-outbreak-mnuchin/6031749/

Bill to address paid sick leave related to COVID-19 (FFCRA) https://www.forbes.com/sites/tomspiggle/2020/03/17/the-families-first-coronavirus-response-act-what-it-does-for-employees-who-need-paid-sick-leave/#615dd2f06f1a

IRS Press Release “Payment Relief” https://www.langdoncpa.com/2020/03/19/official-guidance-for-tax-deadlines/

Single Audit Submission Info https://www.whitehouse.gov/wp-content/uploads/2020/03/M-20-11.pdf

US Department of Labor defines FMLA related to COVID-19 https://www.dol.gov/agencies/whd/fmla/pandemic

IRS extends PAYMENT deadline https://www.cnbc.com/2020/03/17/treasury-and-irs-to-delay-tax-deadline-by-90-days.html

The North Carolina Department of Health and Human Services (NC DHHS) issued a

The North Carolina Department of Health and Human Services (NC DHHS) issued a

Adult Care Homes (ACH) and other types of Group Homes in North Carolina have compliance

Adult Care Homes (ACH) and other types of Group Homes in North Carolina have compliance

budget a few weeks ago. The Senate just passed theirs. As always there are similarities and differences in each department; each of which, have very “hot topics” that are addressed. Thanks to NC Health News for a

budget a few weeks ago. The Senate just passed theirs. As always there are similarities and differences in each department; each of which, have very “hot topics” that are addressed. Thanks to NC Health News for a