by Katie Anthony

It is important to have levels of separation of duties in your business. You may say that you are a very small business and cannot afford to have many employees. That may be true, in which case you can add approval and double sign-offs on items of significance as well as review of certain processes. You may be in a situation where you do not even have enough employees to do this. In such a case, it might benefit your company to set up a monthly or quarterly review by an outside accounting firm.

You may be asking why separation of duties is so important. A big reason is that although a greater number of frauds are perpetrated by employees low on the ladder, greater amounts are stolen by employees at the management level. The ACFE Report to the Nations on Occupational Fraud and Abuse: 2014 Global Fraud Study reports that employees committed 42% of occupational frauds but caused a median loss of $75,000, while executives committed 19% of occupational frauds with a median loss of $500,000. These high level employees are trusted and intelligent, so they are able to get away with the fraudulent activities for a longer period of time, enabling them to steal larger amounts of money.

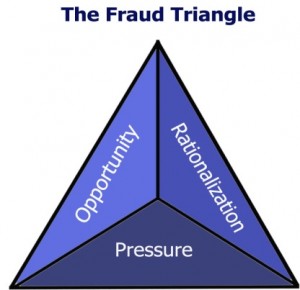

There are three elements to occupational fraud, which are opportunity, rationalization, and pressure, as credited to Donald Cressey. He believed that these three elements must all be present for an ordinary person to commit fraud (Fraud Examiners Manual: 2014 US Edition).

Let’s start with rationalization. You may not think you are able to influence someone else’s rationalization. However, some people rationalize fraudulent actions by saying that they are owed what they are stealing from the organization because they feel underappreciated. You need to take steps to make sure that you pay your employees appropriately for their roles and that you do things occasionally to show your employees that you appreciate them. Employees sometimes even rationalize their behavior based on what they see employees higher than themselves doing. That means you! Keep in mind that your employees are watching you to set the tone of the business.

While you cannot remove pressures employees feel from those outside of your organization, you can make sure that you don’t put too much pressure on them from within. This means doing evaluations that are not only one-sided, but rather structured so that your employees can give feedback about their workloads and stress levels. If you overwork your employees they may feel pressure to take shortcuts that eventually lead to fraudulent actions.

Last but not least, is opportunity. Separation of duties and reviews can really help with this element. If employees feel that no one looks at their work, they may take that opportunity to begin stealing, especially if the other two elements of the fraud triangle are present. By adding separation of duties and reviews, you are filling a gap that will help keep your business healthy. If, despite all your precautions, one of your employees IS stealing, separation of duties and reviews will help catch them. The ACFE Report to the Nations on Occupational Fraud and Abuse: 2014 Global Fraud Study goes on to show that review is second only to a tip in discovering frauds in small businesses.

While no plan to prevent and detect fraud is perfect, each step you take will help. Langdon and Company LLP knows that you want to keep your business healthy and thriving. L&C can help you define the duties in your processes that need separation as well as provide review services for your organization. Contact our office today with any questions or concerns you have.

Katie ([email protected]) is an Audit Staff at L&C and works with a variety of clients.