Categories: Uncategorized

by Josh Bryant

Fall has finally arrived!

With the departure of summer, the hot and humid days are gone, and one of the most widely celebrated holidays among America’s youth- Halloween, quickly approaches. Soon enough ghouls and goblins will be aimlessly wondering the streets in search of sugary-sweets.

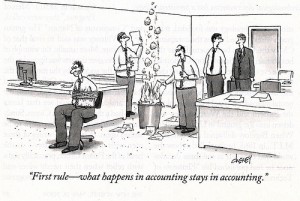

However scary, nothing is more frightening to both consumers and business-owners alike than fraud. Forget running to your local costume emporium for disguises, leave the garlic and silver bullets, this shadowy presence is constantly lurking and has no home-remedies for expulsion.

- Understanding why and how fraud is perpetrated in the minds of those around you is the first and most imperative step. One simple way is to keep the Fraud Triangle in mind. The Fraud Triangle presents the three elements every person has in common when perpetrating fraud: (1) Pressure– Financial or Career Pressure, for example, (2) Rationalization– a way for the person to rationalize their action as being okay, and (3) Opportunity– the ability or perceived ability to commit and hide fraud.

- Communication: by clearly stating, both orally and in a written statement, employees within your organization have a clear understanding of expectations.

- “Tone at the top,” or Modeling: first and foremost, executives in an organization must be constantly aware of how they portray the importance of honesty and character.

- Segregation of duties: in order to stop fraudulent transactions before they happen- having the proper organizational duties prescribed to each individual in the hierarchy is paramount. For example, those who write checks should not be able to book the entry into accounts payable (more on this topic here).

- Effective security, both physical and logical access safeguards to protect information or tangible assets.

- Thorough background checks on employees.

- Keep adequate documentation for an audit trail to catch those that get through the system.

- Hire a CPA to conduct internal audits regularly.

- Have a consistent review process for all employees.

- Stay on your toes, the threat is constantly lurking!

Josh ([email protected]) is a staff auditor who works primarily on non-profit organizations. Please contact our office if we can be of service to you!